Medicare Coverage in Chandler, AZ

Medicare Advantage plans were created under the Balanced Budget Act of 1997 and signed into law by President Bill Clinton and were called Medicare Choice Plans. In 2003, Medicare Choice plans were renamed Medicare Advantage plans.

Medicare Advantage Plans

Are a popular alternative to Original Medicare. What is a Medicare Advantage plan? Well, it’s very similar to group health insurance that you’ve had during your working years. These plans have networks and you pay for medical services as you go along.

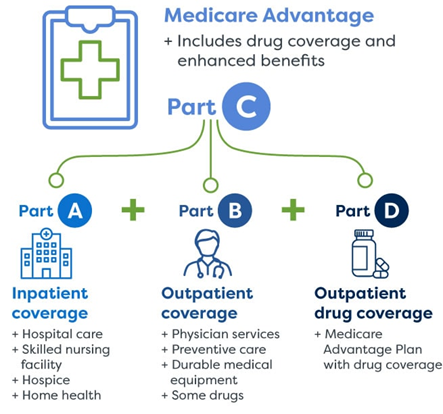

Medicare Advantage is also known as Medicare Part C. It is technically still a part of Medicare, but it is not sold or managed by the federal government. The government sets rules and guidelines, but private insurance companies sell and administer the plans.

You must continue to stay enrolled in both Medicare Part A and B while enrolled in your Medicare Advantage plan. Medicare pays the insurance company to administer your Part A and B benefits through the Medicare Advantage plan.

While all plans must cover the same services as Parts A and B, different Medicare Advantage plans will have different networks, copays, and drug formularies. You will present your Advantage plan ID card at the time of treatment. Your providers will bill the plan instead of Original Medicare.

Most Medicare Advantage plans here in the valley have a $0 premium. They have to include all the same services as Original Medicare but with less out-of-pocket cost and an out-of-pocket Maximum.

For example, most Medicare Advantage plans do not have a deductible.

Most Medicare Advantage plans offer:

- $0 co-pay for primary care visits

- $15 for specialists

- $0 for lab

- $15 for X-ray

- $40 for urgent care

- $135 for ER

Most Medicare Advantage plans include your part D Drug Plan.

Most Medicare Advantage plans offer ancillary benefits like:

- Dental/Vision

- Gym Membership

- Foot Care

- Hearing

- Transportation

- Meal Benefit

- Over-the-Counter Benefit

- And More

Medicare Advantage Networks

Most Medicare Advantage plans have HMO or PPO networks.

Medicare HMO networks are generally required to treat only with network providers, except in emergencies. You will usually need to select a primary care physician. That physician can coordinate a referral if you need to see a specialist. Although, there are some plans here in the valley that do not require a referral.

Medicare HMO plans are the most prevalent type of network. According to a study by Mark Farrah associates, they will represent 71% of all Medicare Advantage plans on the market.

Medicare PPO networks often offer nationwide coverage and do not require a referral. PPOs offer both in-network and out-of-network coverage but if you see a doctor outside the network you’ll have substantially higher out-of-pocket costs.

In limited counties, there are Medicare Private-Fee-for-Service plans. These plans may or may not include Part D. How you access care is also different. While this plan type was very common in the past, it has been slowly phased out in most areas.