Part C (Medicare Advantage Plans) Help Cover

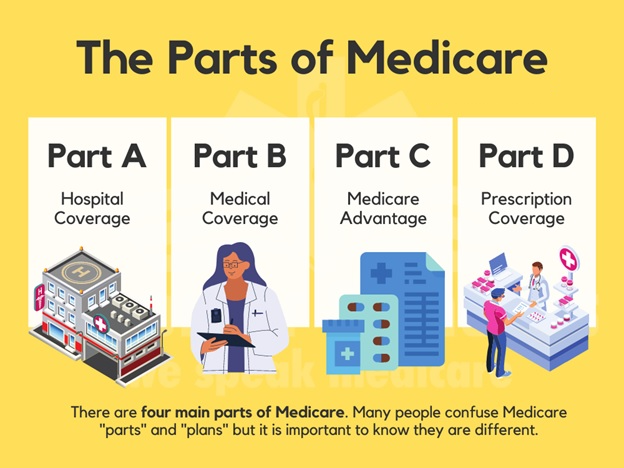

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” or “MAPD Plans” are offered by Medicare-approved private companies that must follow rules set by Medicare.

Most Medicare Advantage Plans include drug coverage (Part D) in addition to services like dental, vision, hearing, fitness memberships, transportation, and other programs, Not Available on Original Medicare. In most cases, you’ll need to use health care providers who participate in the plan’s network.

These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services, unlike Original Medicare. Some plans offer nonemergency coverage out of network, but typically at a higher cost Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans to make many plans have a $0 premium. However, depending on where you live or what plan you choose, you may have a low premium. See more about Medicare Advantage plans.

Part D (Drug Coverage (PDP)) Helps Cover

You join a Medicare drug plan in addition to Original Medicare, or you get it by joining a Medicare Advantage Plan with drug coverage. Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

The costs, design, and formularies vary greatly between the many Part D drug plans. Contact Metro Valley Insurance to help you find the best plan for your drug needs. If you provide us with a list of your drugs, dosages, and quantity, we can compare all the drug plans available in your area to find the most economic one for you!

You are required to have a Part D (Drug Plan) when eligible for Medicare or you are penalized for the remainder of the time you are on Medicare. See how the late enrollment penalty works.

Major changes to part D coverage in 2025

The Inflation Reduction Act, a new drug law, will make several changes to Medicare Part D plans in 2025, including:

- Out-of-pocket costs

Beneficiaries' out-of-pocket (OOP) spending will be capped at $2,000, and there will be no cost sharing above that threshold.

- Coverage gap

The coverage gap phase, also known as the "donut hole", will be eliminated. In the donut hole, beneficiaries pay up to 25% out of pocket for covered medications.

- Benefit design

Part D coverage will consist of three phases: deductible, initial coverage, and catastrophic.

- Prescription drug payment plan

Plans will offer the option to pay prescription drug costs in monthly installments.

Medicare Supplemental Insurance (Medigap)

Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it. However, the price and customer service can vary.